Digital Fundraising Campaign. The digital fundraising campaign was launched on April 1, 2023.

Click HERE or click on the image below to access the posting and donate.

Background.

Since 1964, Soorp Khatch Armenian Apostolic Church has served as the heart and home for much of the Armenian community in the Washington, D.C. metropolitan area. We share countless memories including holy days, Sunday school, community events, christenings, bazaars, and much more. However, we have outgrown our current space; our existing buildings are rapidly aging and difficult to access; and our parking is limited.

For these reasons, the Board of Trustees, with the support of our community, made the decision to purchase the property at 9490 River Road in Potomac, Maryland, to build our future home. In addition to an 86 to 2 vote by our membership in favor of this project, the Prelacy Executive Council also voted unanimously in support of this critical endeavor.

Smart Investment.

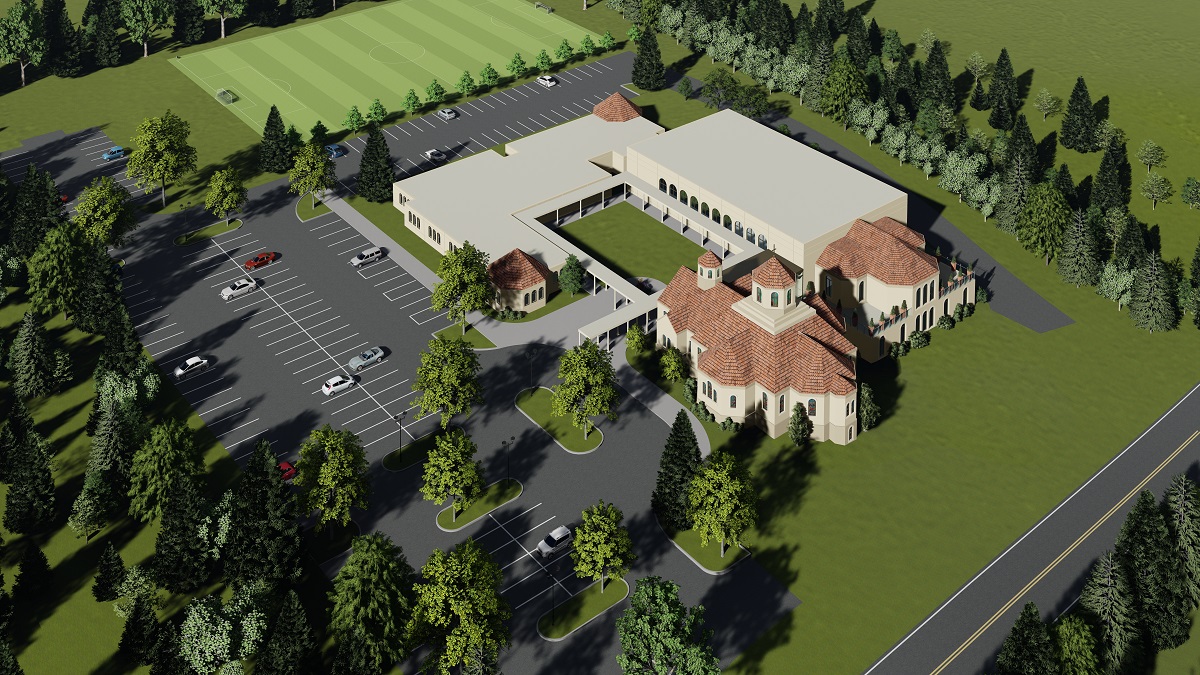

The site consists of 5+ acres of well-appointed land with easy access to River Road, I-270 and I-495. This centrally located property will be convenient to our parishioners across Maryland, District of Columbia and Virginia. The location just outside the nation’s capital will attract Armenians for educational, religious and social gatherings for a long time to come, and it will serve the role of a national institution to showcase the Armenian Church and culture to politicians, decision-makers and influential non-Armenians.

Strong Team.

The Board of Trustees has appointed a special committee to lead the Potomac Project whose volunteer members have experience in real estate, contracting and commercial construction. The committee is assisted by hired professionals, including a site engineering firm, an owner’s representative, an architectural practice and a portfolio of vendors for particular needs (e.g., surveys, natural resources specialists, etc.).

Solid Plan.

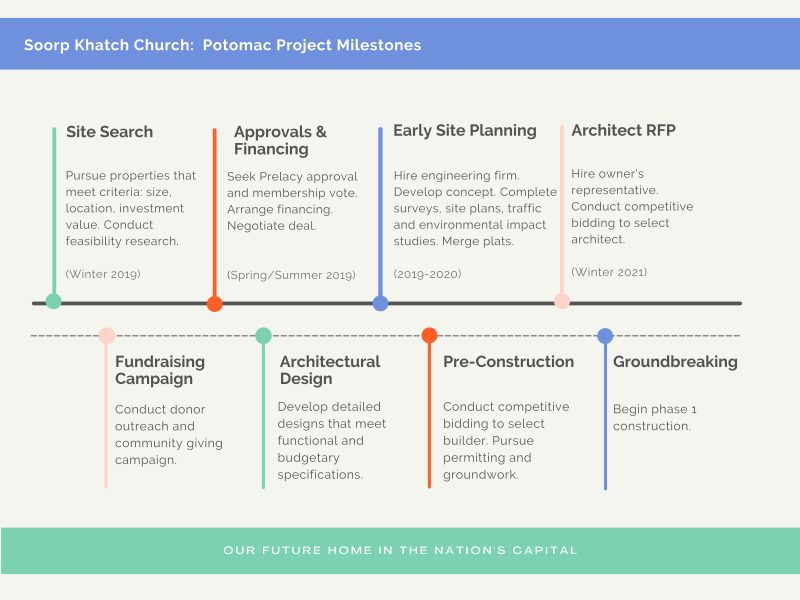

The Potomac Project is a multi-year endeavor organized into stages and milestones. Our goal is to ensure we align with Montgomery County and Maryland requirements efficiently, make steady progress on our plans and deliver the best possible value for our community.

Project Updates.

Donate

Donations to the Church Building Fund can be in forms other than cash. Many individuals who own stock or shares in mutual funds have seen the value of their investments increase over the years. And these gains are subject to taxes. One solution to avoid paying taxes on these gains is to donate the investment. For example, suppose you purchased stock five years ago for $5,000 and the value of the stock is now $10,000. If you donate the stock instead of selling it, you get a deduction on the stock’s full market value and you avoid paying long-term capital gains tax on the $5,000 your investment earned. As a non-profit, the Church Building Fund enjoys the full $10,000 value of your donation.

The safest and most efficient way to donate stocks or mutual funds is via electronic transfer. Your broker is used to this type of transaction and just needs the Church Building Fund’s brokerage information.

You may also donate property you own. The property may be residential, commercial, or investment property. The Soorp Khatch Building Committee will handle the sale of the property and as with stocks and mutual funds, you don’t pay capital gains tax and neither does Soorp Khatch. Please contact Soorp Khatch if you would like to donate property and arrangements for the transfer will be made.

Contributions of stock, mutual funds, and property are deductible to the full extent of the law. If you are interested in donating stocks, mutual funds, or property, we encourage you to consult your accountant to ensure you qualify for the tax savings and that this gift option is best for you. There are conditions and limitations on donations of appreciated property, such as you must have held the investments for more than one year and your charitable deduction is limited to a percentage of your adjusted gross income.